From our friends over at Vanguard, this article provides key insights into selecting the right financial adviser to help you achieve your financial goals.

By Vanguard

We believe financial advice is essential for Australians looking to build wealth and reach their goals, whether in the early stages of their career or during retirement. Financial advice adds tangible improvement to client outcomes through suitable asset allocation, cost-effective implementation, and spending strategies. Not to mention the emotional value of advice, which is often underappreciated. Everyone has different advice needs—from the simple to the complex. But there are some fundamental elements that everyone should look for when assessing their adviser. Here are five of the most critical factors to help you make the right choice.

1. They Take the Time to Understand You

Personal finances can be an intimate topic. The best advisers take the time to get to know you—your interests, aspirations, and motivations—before jumping into your financial situation. Understanding helps build trust and makes you feel more comfortable having money-related conversations. It’s also critical for identifying and setting appropriate financial goals. In addition to investment advice, your adviser helps you navigate spending decisions, superannuation, cash flow management, insurance, estate planning, and other issues. Tailored advice centered on your personal goals is necessary to give you the best chance of achieving the life you want.

2. They Have a Clear Investment Philosophy

An adviser’s investment philosophy is a roadmap for how they manage your money. It encapsulates how they believe markets work and how they can help you reach your investment goals. For example, do they believe markets are efficient or prone to irrational exuberance? How do they match your investment strategy with your risk appetite? A good investment philosophy will encourage you to take a disciplined, long-term view of your wealth. It should be distilled into a set of core investment principles that guide your adviser’s recommendations, set expectations, and help you manage setbacks.

3. They Coach You Through the Market’s Ups and Downs

Investing is inherently emotional. A good adviser acts as a financial coach, guiding you to decisions that align with your long-term goals and interests. They help you develop a tailored plan and navigate the emotional side of markets by providing perspective, expertise, and insight into investor behavior. A good adviser listens to their clients’ concerns, makes sensible portfolio changes, reinforces the long-term plan, and educates clients, instilling trust and confidence.

4. They Use Technology to Enhance the Human Elements of Advice

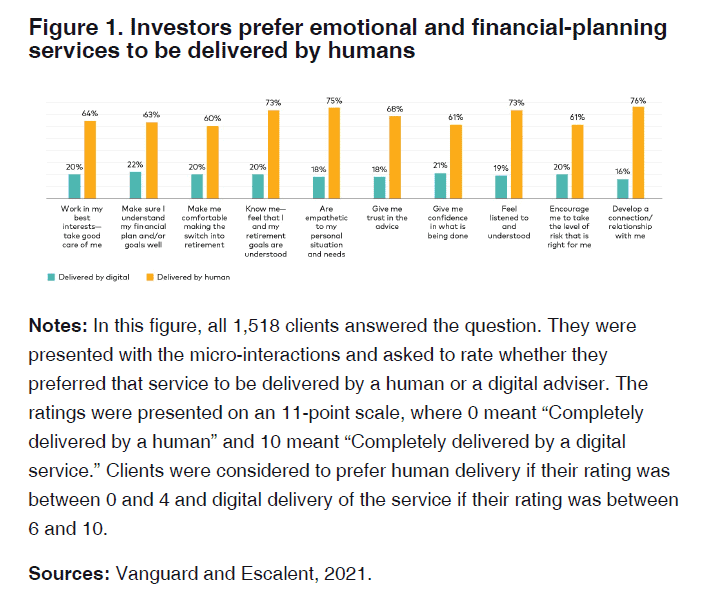

Technology is no substitute for real human connection, but the right technology can enhance your advice experience and simplify processes, leaving more room for the human touch. A Vanguard survey of over 1,500 advised investors found that most prefer dealing with human advisers when it comes to advice delivery. However, technology lends itself well to certain aspects of the advice process, like managing taxes and capital gains, accessing appropriate funds, diversifying investments, and accounting for different scenarios. Advisers should have an intuitive understanding of when digital solutions are appropriate and when their clients want a human at the helm.

5. They’re Focused on Investment Outcomes

Cost remains one of the most important factors that determine investment outcomes. Managing investment costs—whether fees or trading costs—allows you to put more of your money to work. This is why index and diversified funds and ETFs are increasingly used as portfolio building blocks. They allow you to create a tailored, risk-adjusted portfolio that meets your investment needs while keeping costs low. While minimizing fees is important, it should not be the overriding consideration. You need a high-quality investment solution that matches your goals and risk profile.

Talk to Your Financial Adviser

Fears about the future and what markets may bring are natural. A good adviser has the right expertise and understands the emotional side of investing. They can help with a range of advice needs, ensuring you can look to the future with confidence. If you think you could benefit from advice, why not start the conversation with an adviser? Perhaps someone you know can recommend one. For more resources on finding an adviser, or to check the financial adviser register, visit MoneySmart.

Important Information and General Advice Warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer and operator of Vanguard Personal Investor and the issuer of the Vanguard® Australian ETFs. We have not taken your objectives, financial situation, or needs into account when preparing this publication, so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation, or needs, and the disclosure documents for Vanguard’s products before making any investment decision. Before you make any financial decision regarding Vanguard’s products, you should seek professional advice from a suitably qualified adviser. The Target Market Determination (TMD) for Vanguard’s ETFs includes a description of who the ETF is appropriate for. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. You can access our IDPS Guide, PDS, Prospectus, and TMD at vanguard.com.au or by calling 1300 655 101.

Any investment is subject to investment and other known and unknown risks, some of which are beyond the control of VIA, including possible delays in repayment and loss of income and principal invested. Please see the risks section of the PDS for the relevant VIA product for further details.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.