From our friends over at Vanguard, this article delves into the key components of constructing a resilient investment portfolio.

By Greg Davis, President and Chief Investment Officer, Vanguard

ETFs

In today’s volatile market environment, the traditional allocation models like 60% shares / 40% bonds and the conventional roles of asset classes are being questioned. Cash delivered record returns, bonds fell in tandem with shares in 2022, and U.S. equities continue to outpace equities in other developed markets. As central banks tackled inflation with higher interest rates, the speed of change serves as a reminder of the importance of resisting the temptation to chase performance and the necessity of portfolio diversification.

Equities

U.S. equities have significantly contributed to overall market performance since the global financial crisis in 2008-2009. However, the drivers of this outperformance over the last decade may lead to more muted performance in the coming decade. With stretched valuations and slowing earnings growth, we forecast annualized returns of 3.8%–5.8% in the U.S. equity market over the next decade. Investors should be cautious with U.S. equities, considering the expensive valuations and lower expected growth. In contrast, international equities are expected to yield 6.9%–8.9% annualized returns due to lower volatility, cheaper valuations, and higher growth potential.

Fixed Income

Historically, bonds have been portfolio stabilizers due to lower volatility risk compared to equities. Over the past decade, investors favored cash over bonds. However, bonds and cash serve distinct purposes. High-quality bond funds offer better diversification against stock volatility and higher yield potential than cash. Current economic conditions have made fixed income a more viable asset class for medium to long-term savings. We expect global bonds to return a nominal annualized 3.9%–4.9% over the next decade. International bonds can mitigate overall volatility and improve portfolio outcomes through lower correlations.

Cash

Cash is a tool to manage liquidity risk and is suitable for day-to-day needs, emergency savings, or for those with a very low-risk tolerance. It should not be considered a substitute for shares or bonds. Shifting your portfolio to cash may seem appealing in the current high-interest rate environment, but it limits the ability to keep up with inflation and forfeits risk premiums. If central banks cut interest rates, cash yields decrease, causing missed income opportunities that bonds could have provided.

The Importance of Diversification

The current economic and market environment might tempt investors to chase returns. However, chasing returns can expose investors to unnecessary volatility and risk. Our research shows that a balanced mix of diversified assets, combined with a disciplined, cost-conscious approach to investing, can help achieve long-term investment goals.

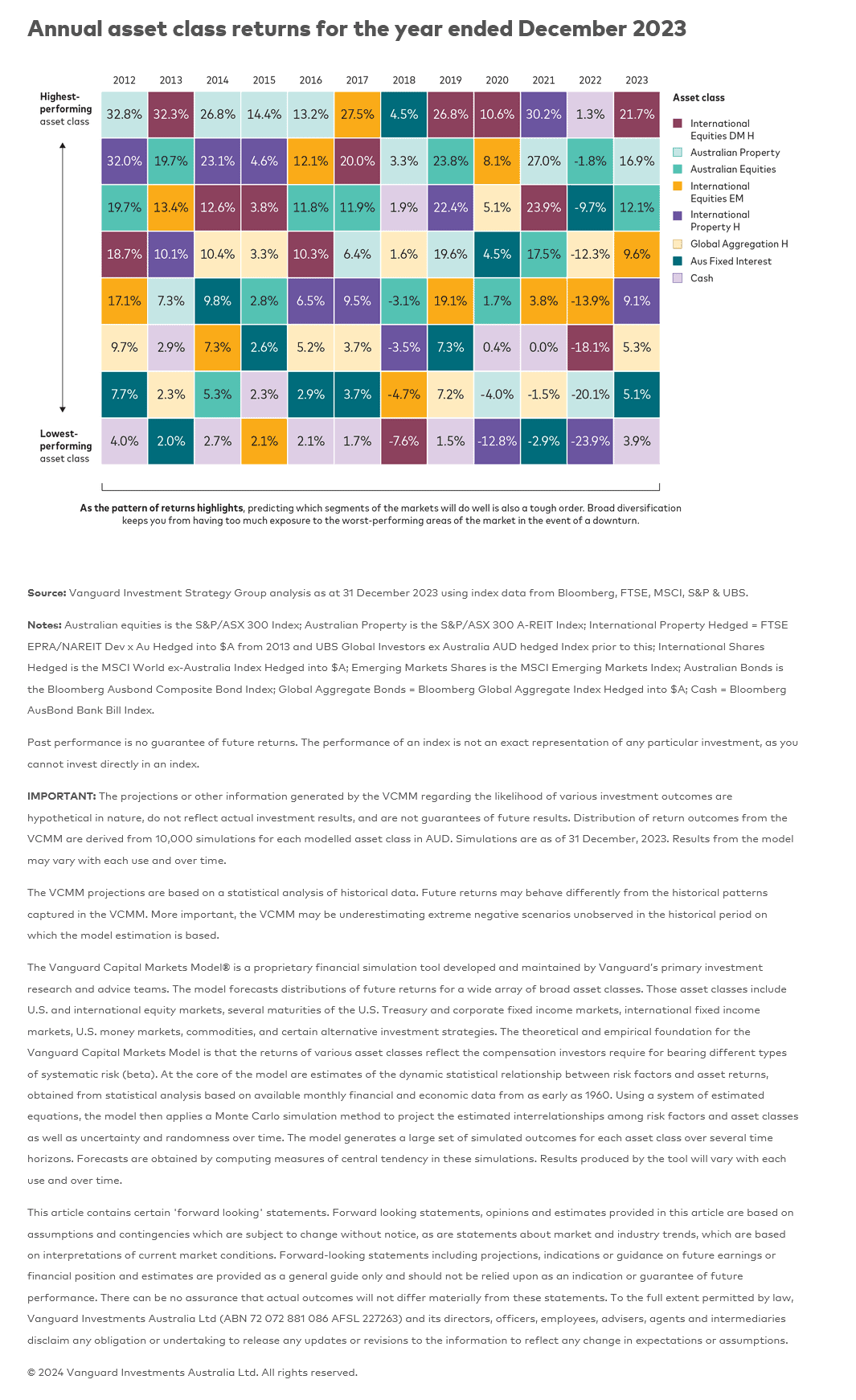

Annual Asset Class Returns for the Year Ended December 2023

Source: Vanguard Investment Strategy Group analysis as of 31 December 2023 using index data from Bloomberg, FTSE, MSCI, S&P & UBS.

- Australian equities: S&P/ASX 300 Index

- Australian Property: S&P/ASX 300 A-REIT Index

- International Property Hedged: FTSE EPRA/NAREIT Dev x Au Hedged into $A from 2013 and UBS Global Investors ex Australia AUD hedged Index prior to this

- International Shares Hedged: MSCI World ex-Australia Index Hedged into $A

- Emerging Markets Shares: MSCI Emerging Markets Index

- Australian Bonds: Bloomberg Ausbond Composite Bond Index

- Global Aggregate Bonds: Bloomberg Global Aggregate Index Hedged into $A

- Cash: Bloomberg AusBond Bank Bill Index

Important Information

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer and the Operator of Vanguard Personal Investor and the issuer of the Vanguard® Australian ETFs. We have not taken your objectives, financial situation, or needs into account when preparing the above article, so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation, or needs, and the disclosure documents for any relevant Vanguard product before making any investment decision. Before you make any financial decision regarding Vanguard investment products, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained at vanguard.com.au free of charge and includes a description of who the financial product is appropriate for. You should refer to the relevant TMD before making any investment decisions. You can access our IDPS Guide, PDSs Prospectus, and TMD at vanguard.com.au or by calling 1300 655 101. Vanguard ETFs will only be issued to Authorised Participants. That is, persons who have entered into an Authorised Participant Agreement with Vanguard (“Eligible Investors”). Retail investors can transact in Vanguard ETFs through Vanguard Personal Investor, a stockbroker, or financial adviser on the secondary market. Retail investors can only use the Prospectus or PDS for informational purposes. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This article was prepared in good faith and we accept no liability for any errors or omissions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.